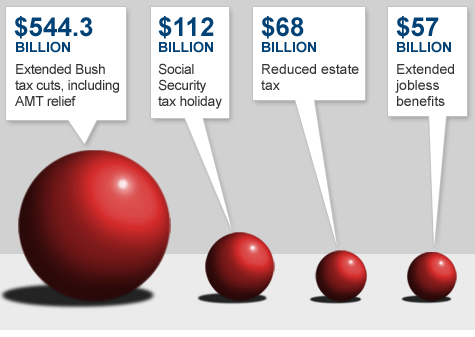

This past week the Congress passed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The tax package was designed to extend the Bush era tax rates for another 2 years, in addition to extending unemployment benefits, lowering the estate tax and other smaller measures. This means that the 2011 federal income tax brackets will remain essentially unchanged.

A few new tax measures were created in addition to extending the current rates, however. Among them was the 2011 payroll tax holiday.

2011 Payroll Tax Holiday

One measure that President Obama wanted to pass as a replacement to the expiring Making Work Pay tax credit that was enacted in 2009 is the new 1 year 2011 payroll tax holiday. The payroll tax, or FICA portion of your paycheck tax withholding – which funds Social Security and Medicare, will be cut by 2% for 2011. The withholding rates for your Social Security taxes will go from 6.2% to 4.2% for the 2011 tax year. The other 1.45% of your FICA taxes go to Medicare funding, and will remain unchanged.

What does that mean for the average taxpayer? Around a $1000 tax savings. Since the Social Security tax is capped at $106,800, the maximum savings that could be seen by a higher income individual is around $2136. This as opposed to a $400 credit for singles and $800 credit for families under the “Making Work Pay” tax credit.

When Will I See The Extra 2% In My Paycheck?

Typically the payroll tax is taken care of by your employer or the company that processes your payroll. You as the employee shouldn't need to take any action – like filling out a W4 withholding form.

New withholding tables have been released by the IRS now, so most employers will begin updating their own tables soon. Since the legislation was passed so late in the year, employers will have until 1/31/2011 to put in place the new payroll tax rate of 4.2%, and make any adjustments or corrections by 3/31/2011. So you should starting seeing it shortly after the new year. If you haven't seen the changes in your paycheck byFebruary, you may want to ask your HR department when the change will be happening.

What are your thoughts on the new payroll tax holiday? Are you glad they enacted something to take the place of the “Making Work Pay” tax credit? What are your thoughts?