One thing that hasn't received very much notice lately I think is the fact that at the end of 2010, the 2001 Bush tax cuts will be expiring for all taxpayers. If you remember, the tax cuts were across the board for all taxpayers, meaning if they aren't renewed, all of us who pay taxes will be seeing an increase in our taxes next year.

Thankfully for many of us Obama has declared that he wants to renew the tax cuts for all taxpayers making less than $250,000 a year.

Obama wants tax breaks proposed by President George W. Bush to expire this year. His budget would eliminate tax breaks on those making more than $250,000 a year, a move almost certain to be opposed by Republicans and perhaps some Democrats as the economy crawls out of the recession.

“We extend middle-class tax cuts in this budget,” Obama said Monday at the White House, but “we will not continue costly tax cuts for oil companies, investment fund managers, and those making over $250,000 a year. We just can't afford it.”

While that's all fine and good, the tax cuts haven't been extended yet, and some are wondering if in the end they actually will be.

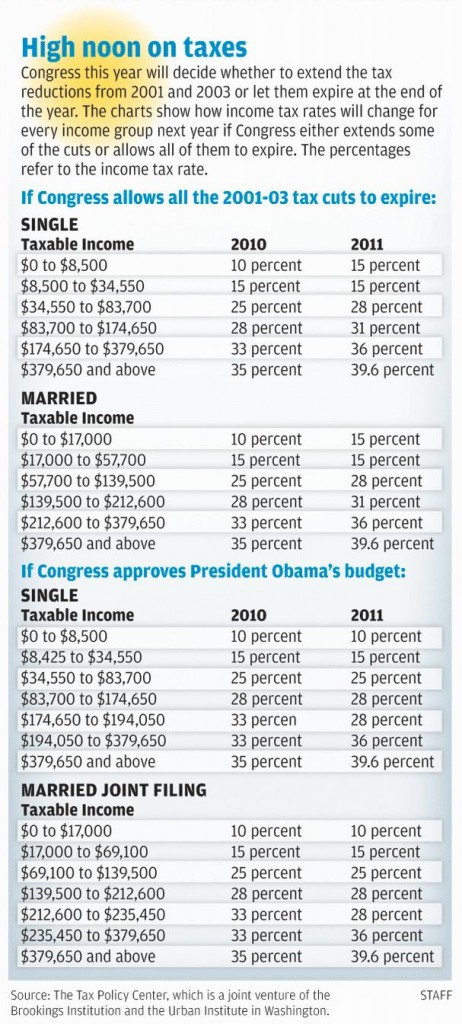

To prepare you for either scenario, here's a graphic from springfieldnewssun.com showing what everyone's tax rates will be if all tax cuts expire, along with if only the tax cuts for those making less than $250,000 (joint) are extended. Personally, I hope they're extended.

What Effect Will Tax Increases Have?

There is a lot of debate as to what effect tax increases will have on the economy, as fragile as it is. Right now it seems that no one wants to allow the tax cuts for lower incomes expire (no one wants to raise taxes on the middle class in an election year!), but the question about tax increases on higher incomes is a contentious one. Democrats are saying it is needed to help close the deficit and Republicans saying tax increases would cripple our economy. I suspect the truth lies somewhere in between.

President Barack Obama wants Congress to extend the lower tax rates for individuals earning less than $200,000 a year and families making less than $250,000 annually.

But under his plan, those individuals making more than $200,000 a year and families above $250,000 would pay higher taxes on income, capital gains and dividends.

By contrast, congressional Republicans are pressing to extend all the tax cuts for everyone. They insist it is folly to raise anyone’s taxes as the economy struggles to recover from last year’s crippling recession. They contend that taking money from anybody will hinder private investment, which will slow economic growth.

Making the debate even more complicated are deficit projections by the nonpartisan Congressional Budget Office.

The CBO predicts that if Congress approves Obama’s budget — including keeping the lower tax rates for families under $250,000 — the federal treasury will lose a staggering $2.2 trillion in the next 10 years.

Joel Slemrod, a professor of economics at the University of Michigan argues that increases on the wealthy are painful but necessary:

Obama’s approach of raising taxes only on the wealthy is probably the safest bet. While acknowledging that the economy will remain shaky next year, Slemrod said “not raising any taxes in the face of this fiscal imbalance also has economic effects.’’

“We start to play out a scenario where interest rates go up,’’ Slemrod said. “So it’s not as if increasing taxes has certain adverse impacts, but not raising taxes do not.’’

Other economists argue that tax increases in this economy would be crippling, and what we really need to be focusing on is decreasing government spending.

Marc Poitras at the University of Dayton, argue that raising any taxes now can choke off the recovery.

“There is no economic model out there of whatever flavor — Keynesian or otherwise — that says that a tax increase is stimulative,’’ Poitras said. “In the long run, they have to do something about the deficit because the deficits they are running are totally unsustainable. The problem with the budget is more of spending (problem) than taxing. It will not be solved until they bring spending under control.’’

To me that is the key to this whole debate, and something that isn't brought up enough. Far too often we focus simply on whether we should raise or lower taxes, when the elephant in the room is the high rate of government spending. We need to closely examine where we are now and where we are going if government spending continues to increase at the current rate. In my opinion it's unsustainable.

What are your thoughts on the expiration of the Bush tax cuts? Do you think they'll extend them for some people – or for everyone? What effect do you think they'll have on the economy? Tell us your thoughts in the comments.

Let the tax cuts exopire and then balance the damned budget by not starting wars you don’t need to start. Taxes don’t bug me so much as the friggin things they are wasted on!! Start means testing on social security and tell congress and the senate they need to live by the same rules and laws they would impose onthe rest of us. That includes having to participate in a social secuirty system they seem hell bent on bankrupting.

Kathleen I agree with a lot of what you said, and let me preface by saying this – I think we need to pull the troops out of Iraq and Afghanistan. But blaming the deficit on the war is not even close to correct. We spent close to a trillion dollars on an economic stimulus 18 months ago that is yet to show any results, and we bailed out ailing businesses instead of just letting them claim bankruptcy. When you run your business poorly and run out of money, YOU GO OUT OF BUSINESS. I am pissed my tax dollars went to bail out companies and give millions of dollars to fund political campaigns. There is no place in our country for that. And damnit, if you aren’t fixing anything in the middle east, get the boys back over here.

To be more precise, President Bush signed the bailout bill for $700B in October, 2008. President Obama signed the stimulus bill for $787B in Feb.,2009. Approved for war spending was (partly) $900B and $549.7M in spare parts through September, 2010. Then there was $1.4B in Haliburton overcharges. These figures do not include billions in mismanaged funds, other lost equipment, guns and rockets, and other “services” (contractors) provided to Iraqi forces- again, BILLIONS. Research and check this out it’s all out there. Americans need to know the actual monetary cost of these UNFUNDED wars. I think they don’t have a clue!

BTW, if you are interested in what the country would have looked like without the stimulus and saving of the auto companies, just Google the 1929-30s depression. The stimulus saved this country from going over that cliff! It might have saved the jobs of those posting here. Ask your grandparents or great grandparents what it was like then. You need to thank Obama and ask why Republicans are not helping. I know why. I hope the American people figure it out soon.

@Ann the great depression was orchestrated by the european (Rothschild) controlled banks that encouraged everyone to over leverage themselves buying stocks and then suddenly calling up all those loans for no apparent reason, except to create a bank run and a devastating liquidity crunch. Their Intent was to create widespread panic so that they could usher in a new central bank that promised “stability” – knowing that the American people were gullible enough to buy it because as history tells, we are always willing to sell freedom for security!

obama’s stimulus did nothing but take from one and give to someone else

“Taxes don’t bug me so much as the friggin things they are wasted on!!”

Like those in gov’t that hold duel offices, duel pensions, have free healthcare, drive free cars and make calls on free cell phones? Not to mention collecting thousands in unused sick days and retiring 20 years earlier than those in the private sector?

Yeah I think the military is well deserving of the money spent on it.. at least it DOES SOMETHING for the people of this country.. unlike the greedy corrupt gov’t workers and pension pigs that use “the children” or so called “needed services as an excuse to keep rapping the tax payer.

You know when you look at the money that the government “gave ” away with out a defined reason, he could of given that billion dollars divided up to the American people . Give the taxpayers the money to help them pay for thier own homes, to help businesses and to reclaim from their loses . Some might put it back into the economy with spending and some might just pay their bills…. which in turn would help the people who barrowed to much money and had job that wasn’t paying enough money to pay for the house, and help to further lower our economy. It’s stupid spending on not just the government but also the american people that put us in this situation… the only problem is what do we do to fix it…. and it’s a shame that we are the ones haveing to clean up YET AGAIN government bull…

I still don’t think most of us understand. If congress does not pass the bush tax cuts does that affect our 2010 taxes or 2011? My income was reduced about $3500 this year but the company gave the money back in a bonus. They will do the same thing for 2011 but have given us a choice to recieve it in December of this year or January of next year. This timing of this tax thing makes a difference. Could you please clarify? BTW; My wife & I pay far more in taxes than we feel is fair. We have sent 5 children to college and are responsible for 5 extremely talented children who now substantially support our country and it government. Thanks

Earlier this week President Obama appointed a committee to basically negotiate a tax cut solution between the Democrats and Republicans. Most people think that they’ll basically extend the Tax cuts for everyone, but only temporarily, like for 2 or 3 years. We shall see. I feel your pain!

And lets not forget Obama tripled the deficit.. Bush’s wars didn’t cost anything compared to O’s domestic spending

http://wizbangblog.com/content/2009/11/14/obama-tripled-the-national-deficit-his-first-year-in-office.php

Despite the wars in Iraq and Afghanistan, Hurricane Katrina, the Clinton Recession he inherited, and the 9-11 attacks, President Bush brought down the national budget deficit from 412 billion dollars in 2004 to 162 billion dollars in 2007.

A guy, you are disgustingly dishonest.

No, Obama did not triple the deficit, he inherited a 1.2 or 1.3 trillion deficit:

http://www.politifact.com/truth-o-meter/statements/2010/jan/29/barack-obama/obama-inherited-deficits-bush-administration/

Bush used the Social Security surplus to mask his deficits, that is how he got his so-called deficit reduction:

http://www.slate.com/id/2093707/

Finally, you forgive Bush deficits in spite of the “Clinton Recession” but fail to give any quarter to Obama for inheriting The 2007-2009 “Bush Recession”, one of the worst in history:

http://www.nber.org/cycles/cyclesmain.html

See this graph to see where the vast majority of our $13 trillion debt was created:

http://www.sachikospace.com/uploads/usdebt.gif

Even as a Libertarian I understand that letting the tax holiday expire will only take money away from a very small filthy rich minority like probably less then 1 percent of the human population of the USA. Wealthy members of the legislature on both sides of the house want to extend to tax cut’s. I am thinking or wishing they will not be able to do this.

@Jeremy Konstenius you must not be much of a libertarian if you are for tax increases of any kind. Raises in taxes essentially equate to central planning – the government thinks they know how to manage money generated by American businesses and individuals than we do. Also a business environment with low taxes encourages a trickle down economy, helping the small person – very much opposite of the effect that a trickle-up nanny state economy has (North Korea isn’t doing so hot).

I agree with where your coming from in spirit. I always considered my self to be a hard core libertarian. Recently I have started thinking of myself as a left civil libertarian I would even say that I am willing to accept the definition libertarian democrat. I think the rich need a deadly taste of the coercive socialist state. I think rich people should pay 75 percent of their global income and assets without exception to the state. What the state does with this money does not concern me. I want rich people to suffer extremely bad at the hands of the state. If this should have negative effects on everybody why should this bother me after all I am a detached intellectual.

I say…let them all expire. All wealth levels. Why? Because it will do one thing: illustrate the point. The rich will not change behaviors or create jobs like people think they will. The situation will be the same and no real financial benefit will come of it either. Sometime you have to actually fail in order to understand what you did wrong.

Here’s my comment for the future regarding tax rate legislation. I think Congress should require itself to enact legislation for one of the following options for the next year: keep tax rate the same OR increase the tax rate by a specified amount OR decrease the tax rate by a specified amount. I.e., Representatives would be required to vote on this legislation for each of their two-year terms.

Trickle down didn’t trickle! The reagan/bush tax cuts for the wealthy did nothing to create jobs in the USA, instead, the wealthy and wall street moved good jobs overseas and left the middle class shrinking. Wealthy folks ONLY pay 15% (current capital gains/dividends tax rate) while middle class folks pay higher income tax rates than that….so we have regressive taxes….the more you make, the lesser the percentage you pay….lottery is the most regressive tax of all taxes….eliminate regressive taxation and return to tax structure of the 60’s when our USA actually grew and all Americans incomes went up, not just the wealthy as is the case today! Regressive taxation kills once strong economies and the USA under GOP has created this losing atmosphere!!

Someone has to pay for the 200,000 extra Federal Employees that King Obama hired since 2009, along with their healthcare, vacations, limos, and he wants to hire an additional 15,000 IRS agents to police the Affordable (lol) Health Care Act. He and Nancy Pelosi and Harry Reid have issued 1,800 exemptions to the Obamacare bill, did you get a waiver? Pelosi’s district and the States of Maine and Nevada get a waiver, McDonalds and Verizon get a waiver, most unions get waivers, how about YOU?

Michelle has spent over $10 million on vacations just in 2011, including renting out all 500 rooms at a hotel in Spain, trips to Africa, someone has to pay for all this.

The 2,900 page Obamacare bill was read by NOT ONE Congressperson, just dropped off on the floor of the House at 3:00 AM, and voted on by the Democratically controlled Congress. Amongst its pages are laws that allow for pets to be covered, so the person down your street who has 6 dogs and 5 cats gets free health care for those animals, paid for by the taxpayer.

Nancy Pelosi caused the loss of 63 Liberal Democratic House members and then explained that the “voters were angry with George Bush”. And so they fired Democrats?? She’s insane.

Don’t for get the Cornhusker Kickback, the Louisiana purchase, and Harry Reid calling Obama a “light skinned African with no Negro dialect”.

Let bush tax cuts expire. Raise new tax to cover bushes drug for senor that he did not pay for. With draw our troops from around the world. Fixing our economy is simple arithmetic Remember that president Harding lowered top tax rate from 71% to 25% in two years when he was setting the country up for the great depression. Harding, Coolege, Hoover did what george bush did to ruin our country financially. We tried lowering tax in bushs administration see where that got us.