Over the past year or so I've written quite a bit about the Obama administration's Making Homes Affordable program, as well as other mortgage modification programs.

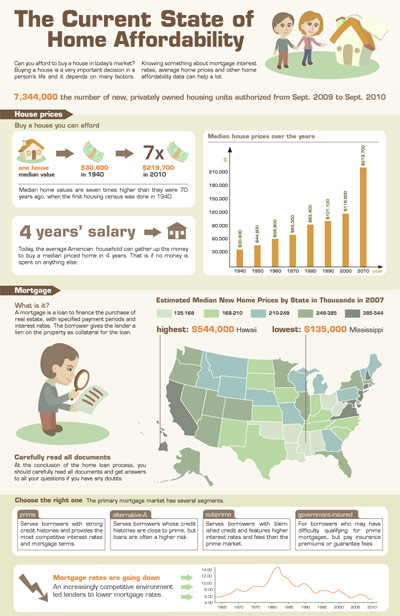

The programs were conceived of and put into place to help homeowners buy homes and prop up a floundering real estate market, in addition to helping homeowners already in their homes – to be able to stay there. The Home Affordable Modification Program aimed to help homeowners facing foreclosure to stay in their homes.

End Or Revamp The Mortgage Programs?

While the heart of those programs may have been in the right place, the management of the programs hasn't been as good as could have been hoped, and now some members of congress are calling for the programs to be either killed or completely revamped.

A handful of foreclosure prevention measures run by the Obama administration are so ineffectual, inefficient and complicated that, according to Republicans in the House of Representatives, the programs should be killed outright.

The House is scheduled to vote this week on getting rid of a refinance program for Federal Housing Administration loans and another program, scheduled to begin next month, that would help homeowners with delinquent payments.

The House Financial Services Committee is expected to vote Wednesday morning on ending two other measures: One of them is a massive effort that was designed to adjust up to 4 million mortgages but so far has tackled just half a million successfully. The other is the Neighborhood Stabilization Program, which steers money to communities hit hard by foreclosures.

The Treasury Department and many Democrats argue, though, that the programs – though flawed – are fixable, and consumer advocates say the measures offer the last, best hope for many struggling families.

“It's all we have,” said Hazel Mack-Hilliard, the director of the mortgage foreclosure project with Legal Aid of North Carolina. “To have nothing and just say let the lenders do it, that's worse than nothing.”

The bills' chances of becoming law are slight, because Democrats control the Senate and the Obama administration supports the programs. But Republicans say their effort will shine a light on inefficient programs that they say aren't working and, in the worst cases, do more harm than good.

Mortgage Programs Hurt More Than Help?

Neil Barofsky, the special inspector general for the modification programs through the Troubled Asset Relief Program, told Congress last week that “HAMP has been beset by problems from the outset and, despite frequent retooling, continues to fall woefully short of meeting its original expectations.”

He blamed the Treasury Department for refusing to adopt “meaningful goals and benchmarks” for the program, but he stopped short of saying the Home Affordable Modification Program should be shuttered altogether.

The program was setup to fail from the start because it had no meaningful goals or benchmarks, and in many cases the banks had more incentive to foreclose, than to modify mortgages.

At this point it sounds like the bills to terminate the mortgage programs will have enough votes in the House, but the Senate and President Obama have signaled that they won't agree to end the mortgage programs. If the programs aren't ended, however, let's hope they are re-tooled and started off fresh – and that they're not just delaying the inevitable for some struggling homeowners.

What do you think? Have you had experience with HAMP or HARP programs? Were you helped by them, or did you get strung along? Did you end up getting denied a modification or refinance despite following the rules? Do you think the programs should be ended?